|

| Sony Walkman (1979) |

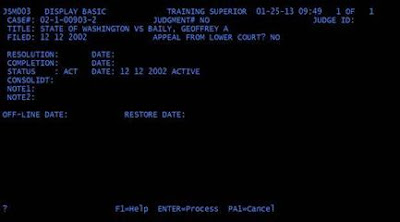

JIS is failing. Today, this behemoth wastes incredible amounts of time and money – and worse, it's unreliable. The system is expensive to maintain and faces the possibility of catastrophic failure.

Courts, like businesses, are urged to do more with less and use technology to work more efficiently and productively. How are the courts supposed to administer justice with a system like this?

A serious problem with JIS is that it doesn't relay to law enforcement when defendants are convicted of felonies. This has placed domestic violence victims in danger and can allow criminals to keep firearms. How can police be expected to protect us if they do not have accurate information on criminals?

|

| Screenshot of the computer system used in Washington courtrooms. |

If we want a justice system that functions and uses taxpayer resources effectively, then replacing these ancient systems is critical. The courts need $20 million to run the computer system and begin replacement.

The Senate Republican budget sweeps the entire $20 million for the JIS database and the replacement of the Superior Court Management Information System (SCOMIS).

It doesn't have to be this way. The House budget proposal fully funds the JIS and the replacement of the SCOMIS system. With this investment, we can greatly improve the accuracy and efficiency of our justice system. We can give judges, attorneys, and law enforcement the tools they need to protect us. And, we can save the taxpayers time and money.

Photo courtesy of the Administrative Office of the Courts and Wikipedia